Selecting a crypto exchange in Canada can be complicated because the country has strict regulations for crypto markets. Even major crypto trading platforms like Binance and ByBit had to leave Canada, leading to troubles for their Canadian users. So, it is essential to be careful and make a wise choice when picking a crypto trading platform if you plan to start trading in cryptocurrency.

We have thoroughly examined, compared, and tested all crypto exchanges available for Canadians to use. Our selection of the best Canadian crypto exchanges is based on a unique methodology that considers various factors, including compliance with Canadian laws, trading fees, security and safety measures, the availability of deposits via Interac e-transfer, coin selection, app ratings from Canadian users, as well as ratings from customers.

When choosing a Canadian cryptocurrency app to purchase digital assets, it is essential to ensure they offer several deposit methods and accept CAD. We prioritized exchanges that allow Canadian deposits with Interac e-Transfer and charge 0% fees. Quick and cost-effective depositing of Canadian dollars is crucial for Canadian investors, and Interac e-Transfer is the preferred method as it is the fastest and most affordable option for Canadians.

While global popular exchanges like Coinbase and Binance may offer the ability to buy crypto with Canadian debit or credit cards, this often comes with high exchange rate fees over 3%. To obtain crypto at the lowest cost possible, using a Canadian-based cryptocurrency exchange that allows Interac e-Transfers is the way to go.

Ease of use

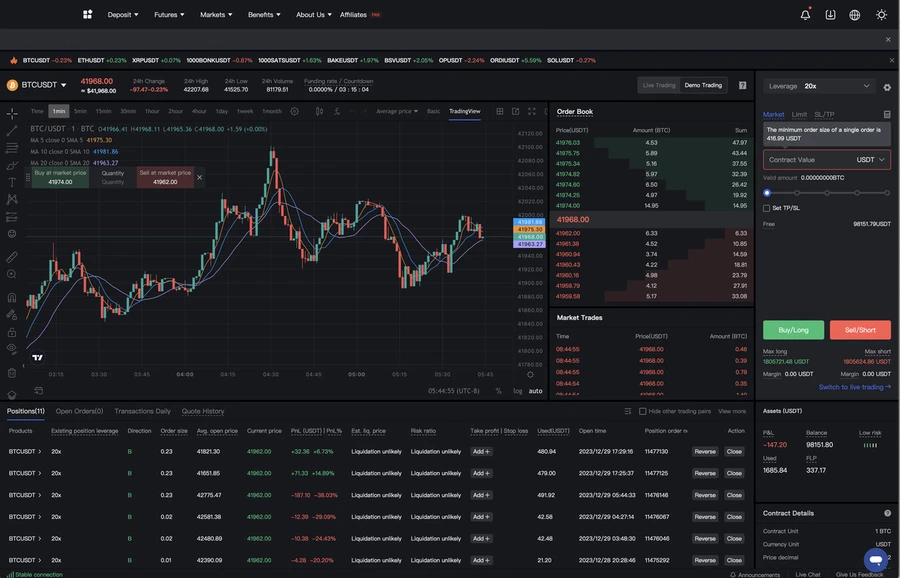

Figure 1

It is important to find a Canadian cryptocurrency app that makes the process of trading crypto as easy and intuitive as possible. Some reputable exchanges have advanced interfaces with charts, like the one shown in figure 1, and order books suitable for seasoned investors.

What is the best way to buy crypto in Canada?

There are a few different ways to buy crypto in Canada, and the best method for you will depend on your needs and preferences. If you are looking for the simplest and easiest way to get started with buying crypto, then using a Canadian crypto exchange like Bitbuy or Newton is probably your best bet. Ultimately, it is up to you to decide which method is best for you.

What are the Crypto Exchanges Authorized in Canada?

Canada has tough regulations for crypto exchanges operating within its borders. Typically, decisions regarding the legitimacy of these exchanges fall under the purview of FINTRAC and the Ontario Securities Commission. For instance, the OSC previously prohibited Binance and ByBit for Ontario residents. As a result, these exchanges, facing stringent FINTRAC guidelines, opted to leave the Canadian market altogether. Nonetheless, some exchanges, such as Bitget and Kucoin, continue to operate in Canada without adhering to these regulations. While it is essential to weigh the associated risks and benefits. If you want to be safe, it is good to use exchanges that follow Canadian laws. Here is a list of those compliant exchanges:

- Bitbuy

- Netcoins

- Newton

- Coinsmart

- Uphold

- Shakepay

- NDAX

- Bitcoin Well

- Coinbase

- Crypto.com

- Coinberry

- Wealthsimple Crypto

- VirgoCX

Which crypto exchange has the lowest fees in Canada?

There are a few different crypto exchanges that are popular in Canada, and each one has its own fee structure. Some exchanges charge higher fees for certain trades, while others have lower overall fees. You might think that Shakepay or Newton have the lowest trading fees in Canada because they are advertised as "no-fee exchanges". In fact, you pay high spreads on your crypto trading activities. After careful research, we found out that BitBuy is the lowest trading fee cryptocurrency app in Canada with only %0.2 trading fees and free deposits.

As a reminder - please exercise extreme caution when transacting with cryptocurrency. Cryptocurrency transactions are not reversible.

If an individual has reached out to you claiming to represent a company, entity, law enforcement, or any government official you should exercise caution and inform them you will contact the company, entity, or the authorities directly to verify if they are legitimate.

Below are a few examples of red flags to be aware of that may help you identify a scam:

Unrealistic Promises

- Any entity that asks for your private keys, passwords, or any personal information.

- Any third-party investment broker or brokerages.

- Any entity that promises to give great returns if you send funds to them.

- Any entity that wants access or control of your funds.

- Any entity forcing you or pressuring you to pay back any debts with crypto.

- Any entity attempting to blackmail or extort you.

Let us know if you have any questions.

Happy trading!

JMD

JMD Live Online Subscription link.

J. Michael Dennis, ll.l., ll.m.

Personal & Corporate Fixer

Skype: jmdlive

Email: jmdlive@jmichaeldennis.live

Web: https://www.jmichaeldennis.live

Phone: 24/7 Emergency Access

Available to our clients/business partners

Disclaimer: All write-ups and articles do not constitute financial and legal advice in any way whatsoever but for information purposes only.

When making financial and legal decisions and commitments, we strongly recommend you consult your professional financial and legal services provider. Our website uses referral links to various crypto exchanges as a means of monetization. We appreciate it if you choose to use the in-article links, but the decision is ultimately yours.