No matter the industry or company size, all businesses must adhere to certain laws and regulations as part of their operations.

Regulatory compliance deals with a set of guidelines that the law requires organizations to follow. It might involve as examples, observing rules set forth by the Occupational Safety and Health organizations to ensure a safe work environment for employees or following the guidelines set forth to ensure discrimination-free hiring practices. Regulatory compliance also pertains to specific industries as well. For instance, some standards outlined for the food industry focus on the entire supply chain to ensure product safety. These would differ from the requirements for the financial services industry, some of which focus on how to handle sensitive data and cybersecurity.

Simply put, regulatory compliance is when a business follows state, provincial, federal, and international laws, and regulations relevant to its operations. The specific requirements can vary, depending largely on the industry and type of business. Regulatory compliance, adhering to governments’ laws and regulations, differs from other aspects of corporate compliance such as following internal policies and rules. While both are important to ensure integrity, safety, and ethical behavior in businesses, it helps to understand the difference.

Regulatory compliance involves following external legal mandates set forth by state, provincial, federal, or international government. In contrast, complying with company policies and procedures involves following internal requirements set forth by the business. Both, however, help drive accountability in the workplace.

Over the last one hundred years or so, the sheer volume of laws, regulations, standards, and guidelines has increased dramatically. Compliance isn’t just for the financial services or healthcare sectors; it touches every industry and has become a vital part of operations. With the regulatory environment constantly evolving, the compliance target is always moving. Your business needs to be able to adapt; otherwise, you put your business at risk.

When your business fails to comply, you open yourself up to potential lawsuits and financial liability. Regulatory compliance helps you protect your business’s resources and reputation. It takes time to build trust with customers, prospects, and vendors, and a big part of that centers on your ethical behavior. Compliance lays the foundation on which you build your company’s reputation.

By not following compliance regulations, you might even risk losing access to certain segments of your customer base.

Protect Yourself, Your Business and Your Company

The regulations are there for a reason: they help protect your business, your employees, and your customers.

Failing to adhere to regulatory compliance requirements can open you up to risks beyond just fines. Security regulations exist to help protect against data breach, financial regulations are there to protect against fraud, and safety regulations are designed to keep workers safe. Although they often do, these compliance regulations are not put in place to make life more difficult. Compliance with regulations benefits your company as well as internal and external individuals.

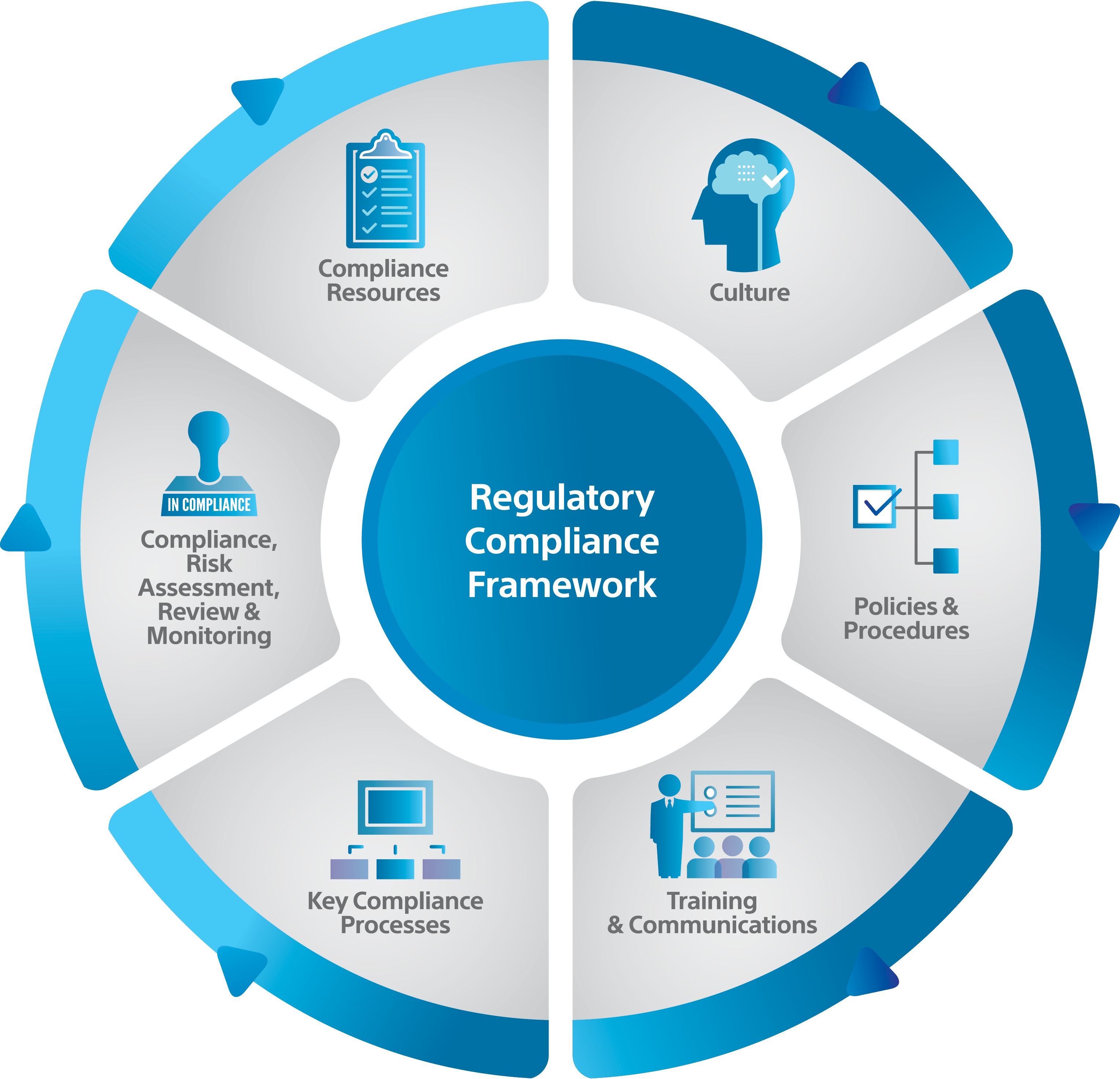

Create an effective regulatory compliance program

Because regulatory compliance is such a big deal, your business needs to take a comprehensive, intentional approach to creating an effective regulatory compliance program. Thorough training g should accompany the program’s implementation to ensure employees understand the importance of regulatory compliance and how it impacts their day-to-day jobs.

Conduct a Comprehensive Compliance Audit

Your first step to regulatory compliance starts with a comprehensive audit to determine a compliance baseline and identify where any problem areas lie. Look at the strengths and weaknesses of everything from security policies to risk management procedures. Assessing risks allows you to not only identify them and their likelihood for occurring but also their potential impact on your business. Once you identify your weaknesses, compliance gaps, or problem areas, then you can put best practices in action. Start by reviewing and tracking how much compliance violations have cost your business.

This Being Done, Find Yourself a Compliance Officer

The designated role of a corporate compliance officer (CCO), either a full time or contractual employee, is gaining prominence in many businesses. The CCO serves as the point person who champions corporate integrity, accountability, and ethics. With the time-intensive oversight involved in implementing and monitoring a compliance program, the CCO’s sole focus is to stay on top of the ever-evolving regulatory landscape and make the necessary compliance decisions.

It is not enough to simply have policies and procedures. They need to address the specific compliance areas identified in your audit. Plus, they need to be reviewed regularly to stay current with the always-changing regulatory landscape. That is why it is helpful to designate a CCO.

Liability and Traceability

In addition to having targeted policies and procedure tied to compliance, a key component of policy management involves the need to track when employees have read and signed your policies. This plays a huge role in being able to prove compliance down the road, if necessary. If you can show the employee knew the policy, read, and acknowledged it, and violated it anyway, then the company’s liability significantly decreases. This provides a much strong position to take action against that employee.

Training

Just like having your policies and procedures tied to compliance issues, you want to “train employees to your policies.”

If the policy is written to address specific compliance issues, then your training should reinforce that behavior and ensure employees comprehend what they are supposed to do. Employees at every level need to adopt the philosophy that compliance is “everybody’s business”.

When your entire workforce understands the importance of compliance and their role in making it happen, it distributes the knowledge broadly. Compliance is not about a handful of people who know the latest regulations and what that means for operations. Rather, everybody is up to speed on the latest changes, and they have been trained on how it impacts them.

Compliance Is Not a One-And-Done Program

Your company needs to build in regular review periods and audits. Your organization should seek input from subject-matter experts (ideally, the CCO) who can track regulatory changes and understand their impact on your business. This allows you to continually assess the effectiveness of the program and be proactive in your actions. It helps to automate this review process, so nothing falls through the cracks.

One of the most powerful benefits of a computerized compliance management system [like JMD’s SCMS] is to allows you to set workflows and reminders to route it to the appropriate people who need to review and make changes.

J. Michael Dennis ll.l, ll.m.

Corporate Ssytemic Strategist